As part of the media extravaganza happening here this week, Ben had the chance to appear Thursday morning (Sydney time) on Sunrise, which is a popular breakfast/news show in Australia.

The segment is adorable, and if you didn’t get a chance to watch live it’s now available online. The majority of the discussion focused on earning points across airline partners, which is a bit tricky to get one’s mind around if you haven’t heard of the concept before.

I think this is a useful topic, not just for Australians, but for anyone who wants to maximize the value out of the flights they do take, so thought I’d recap a bit and provide some other examples.

Airlines have partnerships

Ben has touched on this in his Beginner’s Guide, but understanding how alliances and partnerships work is really key to getting the most out of your miles.

Most legacy airlines (that means the big-name traditional carriers, as opposed to the smaller or low-cost carriers) are affiliated with other legacy airlines, either through alliances or individual partnership agreements.

Let’s use the example of Qantas, given they might have the least rewarding frequent flyer program on the planet.

You can still fly Qantas, but you can credit the miles to any of their partners, including all the oneworld airlines:

Alaska Airlines | American Airlines | British Airways | Cathay Pacific |

Finnair | Japan Airlines | Malaysia Airlines | |

Qantas | Qatar Airways | Royal Air Maroc | Royal Jordanian |

SriLankan Airlines |

And several other partners:

Aer Lingus | Air Vanuatu | China Eastern | Fiji Airways* |

Air Niugini | Alaska Airlines | El Al | Jet Airways |

airnorth* | Alitalia | Emirates |

*These airlines are technically partners, but still use the Qantas Frequent Flyer scheme

That gives you a ton of options other than Qantas, which is good, because the redemption rates are almost universally better in other programs.

So every time you fly Qantas, you can instead earn miles on one of their partners! If you want to earn American miles, just sign up for the AAdvantage frequent flyer program, and give that number when you check in for your Qantas flight. This allows you to accrue AAdvantage miles, which can be a much better overall value.

Compare award charts to find the best values

In order to know which miles are best for you, you’ll want to think about your travel goals. I find having an idea of how many miles a given trip requires makes it easier to plan, and focuses your earning.

The best way to do this is to compare the award charts for the various programs. Each airline has a different system and structure, so you’ll want to look at the specific regions and destinations you’re keen to visit. You can also follow along here at OMAAT, as we often discuss the best values in a given program 😉

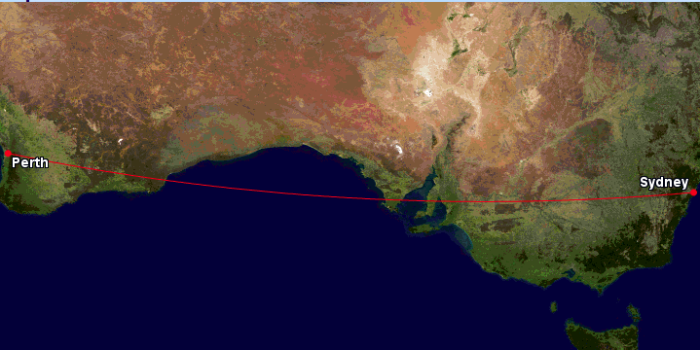

Let’s look for example at a trip between Sydney and Perth.

This cross-country trip is just over 2,000 flown miles, so according to the Qantas scheme, a business class ticket would require 36,000 Qantas points one-way.

If you were to instead redeem American AAdvantage miles, that exact same business class seat would only require 17,500 AAdvantage miles.

That’s a dramatic difference, and given you’re typically accruing at similar rates, you’ll do significantly less flying to earn each reward.

There are partnerships beyond Qantas and American as well! Virgin Australia, for example, partners with Singapore Airlines. This opens up many more redemption options (and a better transfer opportunity for those of you with Membership Rewards cards), along with the opportunity to fly Singapore Suites, which is one of the best first class products out there.

So can I transfer miles from Qantas to American?

No, unfortunately.

In fact, in almost all cases, you cannot transfer miles from one airline to another.

This means accruing the right miles for your flights to begin with is a key part of having a good mileage strategy.

So what should I do with all my Qantas Frequent Flyer points?

You can still use them for flights, and the same concept applies — you can redeem miles on any of the partners listed above! They often have better amenities (Ben mentioned the Emirates A380 shower), and more importantly, better award availability.

As you’re still working within the Qantas scheme, you’ll use their award chart even when flying partner airlines. You’ll still pay Qantas’ high fees when redeeming Qantas points, unfortunately, but even the hefty surcharges can still be a decent value for a great product.

Alternatively, Qantas points can be leveraged towards upgrades on Qantas flights. That’s a topic for another post (the scheme and process can be complicated), but it is an option.

Overall though, you can anticipate a large cash supplement when redeeming Qantas miles. It’s unfortunate, particularly given the stranglehold they have on the Australian market, but as long as you are aware and can budget accordingly you should be able to squeeze some value out of the points.

What’s next?

Check out the links around the site to learn more about redeeming miles (the Tips & Tutorials section is particularly useful), along with the Trip Reports to see examples of the amazing things you can do with miles.

If you are based in Australia, Ben will be doing another segment with Sunrise on Friday morning. If you have questions you’d like him to answer on the show please leave them on the show’s Facebook page:

SEND US YOUR QUESTIONS! We’ve already been flooded with questions for our last guest Ben Schlapig who is traveling the…

Posted by Sunrise on Wednesday, July 22, 2015

Otherwise, feel free to comment here (or over on our great Ask Lucky forum) and we’ll do our best to point you in the right direction!

Quick question. Can you please explain what is meant by "you can earn miles on our partner airlines by flying with so and so".

For instance, I just booked on American Airlines. I have AAdvantage membership, so I earned AAdvantage miles with this booking, but do I also earn miles for EACH and EVERY one of American's partners? That cannot possibly it, yet that's what the above quote suggests. Can someone please explain in an easy to understand way?

Thanks!

@ Jonathan -- Correct. You can choose from any of those partners, but you can only pick one at a time.

Thanks! How is that usually done? I don't see a box or something like that during the booking process. Is this something I have to call in for?

@ Jonathan -- You can call, or you'll have the option when you check in for your flight :)

@Ed, you are wrong about Bankwest, they no longer offer 50,000 point bonus nor reduced annual fee. There are also a few non Amex cards offering higher points earn at 1:1including hsbc, Jetstar, macquarie, and Citibank

@Ed: yes, there are a few with transferable currency that's worth considering, although they are all high end cards.

Westpac's Altitude Black card is pretty good in terms of transferable partners. It covers krisflyer, Asia miles, velocity, enrich and Air NZ. The first 3 are really useful and the earn rate is quite good. 1.5 ffp/$ on Amex and 0.625 ffp/$ on the MasterCard. (It earns in the form of altitude point at 3pt/$ Amex...

@Ed: yes, there are a few with transferable currency that's worth considering, although they are all high end cards.

Westpac's Altitude Black card is pretty good in terms of transferable partners. It covers krisflyer, Asia miles, velocity, enrich and Air NZ. The first 3 are really useful and the earn rate is quite good. 1.5 ffp/$ on Amex and 0.625 ffp/$ on the MasterCard. (It earns in the form of altitude point at 3pt/$ Amex and 1.25pt/$ for MC domestic 3pt/$ for international, and transferable at 2:1). High annual fee of just under $400 but you also get 2x priority pass lounge access per year.

Citi Signature visa earns citirewards that can be converted to KF and VA at earn rate of 1ffp/$ for annual fee of $299.

Citiprestige is the best at 1.33 KF&VA pt/$ and variable earn rates for 10 other FFPs, mostly 1pt/$. The rate goes much higher for international spent, 3.33 KF&VA/$ spent! This is as high as Visa card earn rate goes but also comes with a hefty $700 annual fee. But if you are like Ben that can make good use of the 4th night free feature for hotel stays, the $700 easily pays off.

Another useful card or Aussies is the Bankwest Qantas Platinum MasterCard cards. It often has a 50,000 point signup bonus and a reduced first year annual fee. Look out for those offers. Key feature on that card is no foreign transaction fees and 0.75 qantas points per dollar which is about as high as you can get for a non-amex card.

You can often find 1.5 QF points per dollar on bank issued Amex cards...

Another useful card or Aussies is the Bankwest Qantas Platinum MasterCard cards. It often has a 50,000 point signup bonus and a reduced first year annual fee. Look out for those offers. Key feature on that card is no foreign transaction fees and 0.75 qantas points per dollar which is about as high as you can get for a non-amex card.

You can often find 1.5 QF points per dollar on bank issued Amex cards but beware high annual fees and surcharges on amex transactions or stores outright not accepting amex at all in Australia.

Look out for high signing bonuses with no first year annual fee offer on cards offering Qantas points. ANZ currently has a 50,000 point offer with no first year fee, check the Qantas website. Commbank just finished an offer, and I've been successful with NAB in the past.

I've not really dabbled in the transferable points currencies here but there are several none of which seem that lucrative but maybe I need to dig a little deeper.

SO here we go a link for 110,000 point signup for the Virgin Velocity Platinum American express card. Please be like Ben and thoroughly read the Terms and Conditions before applying

Highlights

110,000 points after $1000 spend in the first three months (I get 20,000 for referring, just so you know)

$395 annual fee (oof but this australia)

1 free domestic return flight every year (restricted city pairs but pretty reasnoble)

2...

SO here we go a link for 110,000 point signup for the Virgin Velocity Platinum American express card. Please be like Ben and thoroughly read the Terms and Conditions before applying

Highlights

110,000 points after $1000 spend in the first three months (I get 20,000 for referring, just so you know)

$395 annual fee (oof but this australia)

1 free domestic return flight every year (restricted city pairs but pretty reasnoble)

2 Free Lounge Passes

3 miles per AUD on restaurant spend

2 Miles per dollar on Virgin Spend

1 Mile per dollar on everything else

https://www316.americanexpress.com/iFormsSecure/un/iforms.do?cuid=emgmMgmee_en_AU&evtsrc=link&evttype=0&tkn=3C811750CCE9FD36C2F75A35E1ED3E1388596324B148697A17CA779F53031BB2&mgmerSource=mgmerHub&MGMURN=AAAABgQeAx8XFQ==&CPID=999999483

@tiffany autofill put my full name in any chance you could delete the surname?

Thanks.

@Patrick

It's when people used to be able to buy cash on credit, that then was then funnelled straight back to pay off the purchase. The ultimate manufactured spend.

The closest today is generally buying credit on credit, usually store gift cards and the like (or similar), which are then sold off on EBay and the like for cash to repay the charge. More complicated and usually at a cost.

Personally I don't bother...

@Patrick

It's when people used to be able to buy cash on credit, that then was then funnelled straight back to pay off the purchase. The ultimate manufactured spend.

The closest today is generally buying credit on credit, usually store gift cards and the like (or similar), which are then sold off on EBay and the like for cash to repay the charge. More complicated and usually at a cost.

Personally I don't bother with manufactured spend as I find it unnecessary, given my real spending gives me a good swag of points anyway (and it takes time and energy I rather spend elsewhere). But some people devote a lot of time and energy to it. To each their own.

What is coin buying??? "Some Hobbyists have taken advantage of the system by buying dollar coins and then immediately paying their credit card bills off - as if they had spent no money at all"

@ Patrick -- It doesn't exist anymore, unfortunately.

Since retiring I no longer fly interstate on business. I now rely solely on credit card Qantas points. I pay all my bills on credit card as well as all shopping and ensure I pay off the card each month by the due date so as not to pay interest. I use very few cash purchases. Buying groceries I receive Qantas points from my credit card and Qantas points from the store for loyalty (double...

Since retiring I no longer fly interstate on business. I now rely solely on credit card Qantas points. I pay all my bills on credit card as well as all shopping and ensure I pay off the card each month by the due date so as not to pay interest. I use very few cash purchases. Buying groceries I receive Qantas points from my credit card and Qantas points from the store for loyalty (double dipping). By this method the wife and I have redeemed round the world tickets, Sydney to New Zealand return tickets, twice Sydney to Fiji return tickets, Sydney to Perth return tickets and am still holding about 200,000 points. Can recommend credit card points accumulation.

As a resident in Australia who only fly cheapest discount fare on QF, I still credit all my flights to QFF. Even though the redemption rate is poor, the earn rate is much better than AA or AS. As mentioned above, SYD-MEL-BNE (AKA golden triangle) would only earn ~100 points with AA, 0 points with AS but 800 points with QF on the most discounted ticket. Unless the redemption rate of AA is 1/8 of...

As a resident in Australia who only fly cheapest discount fare on QF, I still credit all my flights to QFF. Even though the redemption rate is poor, the earn rate is much better than AA or AS. As mentioned above, SYD-MEL-BNE (AKA golden triangle) would only earn ~100 points with AA, 0 points with AS but 800 points with QF on the most discounted ticket. Unless the redemption rate of AA is 1/8 of QF, overall it's still better to credit it to QF.

Having said that, I don't redeem my OW flights (including QF metals) using QFF points. I find it cheaper to use Asia Miles, which is another program that can earn miles easily in Australia through credit card sign up/spend. I reserve my QFF points for Emirates and Jetstar flights, as there is no other alternative in Australia to redeem these flights.

@James

The old US of A market is definitely king when it comes to non-flight activity point generating capacity. Europe might not get such great opportunities as U.S. residents, but a lot of Europe benefits from consumer protection against unfair bank and merchant fees (for credit card use service charges) for their non-flight activity point generating capacity, so at least that's something.

Australia tends to get the worst of both worlds, nowhere near the U.S....

@James

The old US of A market is definitely king when it comes to non-flight activity point generating capacity. Europe might not get such great opportunities as U.S. residents, but a lot of Europe benefits from consumer protection against unfair bank and merchant fees (for credit card use service charges) for their non-flight activity point generating capacity, so at least that's something.

Australia tends to get the worst of both worlds, nowhere near the U.S. for credit card benefits & non-flight activity point generating capacity (and even sub-par to Europe in quite a few cases) and we get slugged constantly with outrageous fees and charges that have no connection to the actual costs involved (it can cost orders of magnitude more to purchase a promotional airline ticket with a credit card here, for example, than the cost of the promotional fare itself). Our banks are some of the richest in the world thanks to the rivers of gold they create in credit card fees (for which they don't provide a lot back in benefits), and Australian airlines and many other merchants in the travel industry have fattened their bottom line by throwing ridiculous charges on top of that.

Qantas allows flight taxes for redemption flights to be paid either by credit card (which carries a percentage penalty) or use of extra points. Which is the best method ?

@ Michael Ellen -- It depends on your situation, really. I'd lean towards the credit card option personally, but some people might prefer to not spend the extra cash.

Agree with Joey, you pretty much get Qantas points for breathing in Australia, it's very easy to rack up a lot of points through credit card signup bonuses, spend, shopping portals etc.

Virgin isn't quite so good, but there is a 100,000 point Amex signup bonus for their Virgin velocity platinum card, which also comes with a free domestic flight every year which takes care of the annual fee.

I believe link trading...

Agree with Joey, you pretty much get Qantas points for breathing in Australia, it's very easy to rack up a lot of points through credit card signup bonuses, spend, shopping portals etc.

Virgin isn't quite so good, but there is a 100,000 point Amex signup bonus for their Virgin velocity platinum card, which also comes with a free domestic flight every year which takes care of the annual fee.

I believe link trading is frowned upon here but if it weren't I could offer a link to a 110,000 point signup offer.

@ Edward Lynch-Bell -- We actually don't mind! We're not experts on Australian credit cards, and that sounds like quite a good offer for Australians!

Schlappig should practice talking without moving his hands constantly.

I agree with you that AAdvantage miles offer far better value than Qantas points. However, one point to consider is how easily attainable a certain 'currency' is in your particular location. If I'm in Australia with a Qantas-affiliated credit card and travel only a few times a year, then I'd most likely opt to focus on Qantas as my main FF program (and perhaps do MS on that Qantas credit card to rack up the...

I agree with you that AAdvantage miles offer far better value than Qantas points. However, one point to consider is how easily attainable a certain 'currency' is in your particular location. If I'm in Australia with a Qantas-affiliated credit card and travel only a few times a year, then I'd most likely opt to focus on Qantas as my main FF program (and perhaps do MS on that Qantas credit card to rack up the miles). Yes, the redemption rates are higher than AA and what not, but to my knowledge, there isn't any AAdvantage credit cards in Australia. In addition, the cheapest QF flights only credit 25% mileage to AAdvantage so earning enough AAdvantage miles for a First Class redemption for the average Aussie may take a long time.

If I fly well over 100k miles a year in paid business class for work, then yes of course I'd credit all those flights to AAdvantage!

It kinda makes me laugh a little bit in regards to points.

I now live in the US, lived in England for 20 years, Australia for 4.

The rest of the world will soon realize that CC sign up bonuses suck outside of the US.

Australia & the UK have very poor CC sign up bonuses. And the US cards that offer great bonuses you need an SSN to get them.

I always tried...

It kinda makes me laugh a little bit in regards to points.

I now live in the US, lived in England for 20 years, Australia for 4.

The rest of the world will soon realize that CC sign up bonuses suck outside of the US.

Australia & the UK have very poor CC sign up bonuses. And the US cards that offer great bonuses you need an SSN to get them.

I always tried to collect points when I lived in the UK and OZ, and probably made about 500,000 from CC sign ups and actual flying, also note banks seem to be more strict outside the US and don't let you have 15 credit cards.

Since moving to the US in 2011, I have built up over 2.4 million miles over AA,BA,DL,UA from sign up bonuses and flying, its just a lot easier to do this in the US than other countries.

Just saying, I wonder if people will be frustrated by this.

Tiffany:

Off topic - I have a challenge for you - I would like to Fly from WAS to Victoria Falls, Zimbabwe (VCF), stopover, then fly from VCF to Zanzibar, ZNZ, stopover and then back to DC in June 2016. I have loads of American and Delta miles. How do I do this?

@ Nkk -- Well, neither program allows stopovers anymore, so you're looking at three tickets. Depending on your balances you could book the outbound as far as Johannesburg on Delta or American, and then BA flies to VFA. For the return I would absolutely look at using American miles on Qatar.

Also one thing about crediting qf domestic flights to aa that needs to be considered is that qff offers a minimum 800 points per flight. For MEL - SYD in discount economy aadvantage will only pay max 50% miles for a 400 odd mile trip. So despite the terrible redemption rates, you're only earning max 1/4 of the miles/points.

Just watched the Sunrise appearance by Ben, and not only did Kochie *not* embarrass the nation again, but this exactly the sort of media coverage Lucky should have!

Ben did really well, and came across charming, knowledgeable, and left a great impression. No wonder Sunrise has asked him back - might even end up as a repeat commentator. Far better than that questionable write-up.

The only thing I would say is that Virgin Australia has...

Just watched the Sunrise appearance by Ben, and not only did Kochie *not* embarrass the nation again, but this exactly the sort of media coverage Lucky should have!

Ben did really well, and came across charming, knowledgeable, and left a great impression. No wonder Sunrise has asked him back - might even end up as a repeat commentator. Far better than that questionable write-up.

The only thing I would say is that Virgin Australia has excellent redemption availability, and has very decent redemption rates on it's own metal. Ability to redeem premium cabin seats out of Australian East Coast via KrisFlyer often is not available at Saver level, so there's not much leverage there. Much easier to receive elite benefits on Virgin Australia's Velocity program, than to on Singapore Airlines KrisFlyer/PPS too. I know Ben was generalising across the Australian schemes, and certainly agree about Qantas Frequent Flyer not being the best choice for OneWorld flights, but more care and careful assessment is warranted before crediting Virgin Australia flights to other frequent flyer programs (especially as it's not that hard to status match to Star Alliance Gold elsewhere for nix).

Interesting sentiments expressed by the hosts about being ripped off in Australia.

Yes, Qantas Frequent Flyer scheme is the terribly unattractive. Expensive redemptions, big surcharges, poor to middling earn rates (for status and redeemable miles) especially on partner airlines, lottery upgrades for all international flights (with even elite status holders often having very hit and miss point upgrades), high barriers for elite status, unfriendly and very subpar call centres (even for elites, outside of CL & P1, the above OneWorld statuses), and very thin spread of award...

Yes, Qantas Frequent Flyer scheme is the terribly unattractive. Expensive redemptions, big surcharges, poor to middling earn rates (for status and redeemable miles) especially on partner airlines, lottery upgrades for all international flights (with even elite status holders often having very hit and miss point upgrades), high barriers for elite status, unfriendly and very subpar call centres (even for elites, outside of CL & P1, the above OneWorld statuses), and very thin spread of award seats (ironically you have a better chance of redeeming on partner airlines, than you do on Qantas tin, for international premium cabin flights).

Far better to be an elite with AA or CX, where your Qantas flight earns go much further. If it wasn't for my Lifetime status on Qantas and that it provides a decent bridge to Emirates, I would have abandoned it long ago.

Must watch that segment on Sunrise with Ben, if only to see what stupid things Kochie says to Ben lol.

Ahem, Ben is encroaching on my territory ;)

If I had a proper notice I could catch up with him!

Thank you Ben for brightening an otherwise crappy morning (dealing with the aftermath of an Austrian cancellation) in Vienna, was great to see your segment on my favourite show back home. And thanks to you, Tiffany, for posting the link and looking forward to your next post.

With OneWorld airlines like Qantas and Cathay you have to be very careful about what fare base you select... the cheapest Qantas domestic fares earn 0 status credits and 0 miles with Cathay [I found out the hard way!] If you at least use Qantas to collect the points you get something -- plus you get better bonuses for biz and first class travel... So a first class Emirates flight from Sydney to London with...

With OneWorld airlines like Qantas and Cathay you have to be very careful about what fare base you select... the cheapest Qantas domestic fares earn 0 status credits and 0 miles with Cathay [I found out the hard way!] If you at least use Qantas to collect the points you get something -- plus you get better bonuses for biz and first class travel... So a first class Emirates flight from Sydney to London with a QF number is worth WAY more on a Qantas card than if you take the same flight with the Emirates flight code. Also, I've become a bit of a Qantas convert as I find their website for upgrades to be very user friendly (though a bit annoying that you don't find out until very close to the flight if you have an upgrade...)

What would you recommend as the best earning strategy if I'm based in Vienna (VIE) and there's basically Austrian (aka Lufthansa aka Miles & More) domination? I almost exclusively take the cheapest economy flights with them (they're still *really* expensive), which earns only 125 miles per one-way (and that is only if I use M&M, on other Star Alliance partners these "K" fare flights earn a pure 0). In many cases it works out that...

What would you recommend as the best earning strategy if I'm based in Vienna (VIE) and there's basically Austrian (aka Lufthansa aka Miles & More) domination? I almost exclusively take the cheapest economy flights with them (they're still *really* expensive), which earns only 125 miles per one-way (and that is only if I use M&M, on other Star Alliance partners these "K" fare flights earn a pure 0). In many cases it works out that I basically pay €1 per earned mile (€250/return ticket which earns 250 miles). With redemption costs in M&M programme being so high (30k or sometimes 10k when they run a promotion for flights with low demand), I can never earn enough miles (because, as we know, they expire after 3 years). There are no credit cards available for me, unfortunately. Is there any way I could maximise my miles earning (I know there might not be)? Thanks.

Heads-up: you can't actually credit Qantas flights to Airnorth, Air Vanuatu or Fiji Airways, as none of these airlines has a frequent flyer program of its own.

(The first two only use QFF, while Fiji Airways also uses QFF plus AA and Alaska MP...)

@ Chris -- Thanks! Was trying to be efficient and use an earlier table. Added a note :)